English race car mechanics often refer to the engine in their race car as “the lump.” Most of those lads are chassis oriented, and “the lump” sums up their attitude that the engine is a big, heavy thing that must be worked around.

In many respects the nickname could be valid in the sport aviation world. After all, the engine is a big, heavy, expensive bit of metal that somehow the homebuilder has to get around while investing himself in the airframe. He has to choose the right engine. He must make seemingly endless accommodations for its size, weight, appetite, and rejected energy, and above all, he has to buy or build one. None of these are easy propositions, so who’s to criticize the builder who puts his engine chores near the bottom of the list?

Then again, there are the gearheads and engineers among us who naturally embrace propulsion systems. To those of us tuned to that frequency, selecting an engine and mating it to the airframe is all part of homebuilding joy.

Today the development money is in drones, such as this Northrop Grumman Firebird. Its 350 hp Lycoming TEO-540E gains a real-world test and provides economies of scale for sophisticated engine management systems and other improvements that will eventually find their way to private aircraft.

No matter which hangar you hang out in, there comes a point where you’ll need to select an engine, and the very first step is discovering which engines are available. To that end we present our annual Engine Buyer’s Guide. Its aim is to sort out today’s engine offerings, thereby saving you research time. We’ve further broken down our engine coverage into two stories. This month we’re exploring traditional engines—those originally intended for aircraft operation. We’ll cover alternative engines, those originally designed for something other than aircraft use, separately in a later issue.

Fuel Driven Change

Bemoaning the “1950s technology” of today’s traditional engines is a tired cliché by now; but the reality is the traditional light plane engine universe is stirring. Last year among our generally dark mood, we sensed new forces afoot in the engine market; this year the move to new engines, new supporting systems, and above all, new fuels is palpable. The increasing drive to unleaded avgas is fundamental to engine design and economics and is the direct push behind the ever-growing emphasis on diesel engines. The piston Jet-A burners are not here yet, may well never be the homebuilder’s first choice, but they are coming and that’s the buzz with the big-name engine makers and new start-ups.

It’s important to understand the scale of this new weather front in engine economics. Above all, the domestic engine market is stagnant. The recent economic collapse was the load of bricks that buried many a marginal small shop and gave major engine manufacturers inescapable reason to reevaluate who their customers are. Back in the glory days that might have been Cessna and Piper, but today the research money comes from military drone programs, plus there’s the siren song of emerging markets overseas. Both of these customers need Jet A or diesel fuel, or possibly unleaded mogas alternatives because 100LL isn’t available. In other words, it’s a global market and what you want or need in an aviation engine is competing with what Asia, Australia, and South America want as well. May the largest market win.

Furthermore, lead-free, diesel-based fuels offer energy density advantages gasoline can’t quite match—more miles from a gallon—and the infrastructure for these fuels is already in place and working, so Jet A/diesel is one answer to the noisy environmental drumbeat against 100LL. Against that is the higher initial cost of a compression ignition engine, not to mention the crushing costs of developing and certifying a new aircraft engine in the U.S. Diesel engines are efficient, but it’s going to be a long time before they are cheap.

All of this is a factor in future development, and thus constraining current development of 100LL burning engines by the big engine makers. But the so-called “heavy fuel” engines aren’t here yet and won’t be the homebuilder’s overriding powerplant choice for years to come, if ever. The U.S. market is still the 900-pound gorilla of general aviation, the economic propwash of new $100,000 diesels isn’t going to blow away the legacy 100LL engines anytime soon, and fuel producers can still make good money selling gasoline at $6.00 a gallon. So, down at the aftermarket parts, overhaul, and custom shop level, the story remains the same. The already well-developed Lycomings and Continentals are continuously massaged by these independent shops in the never-ending quest for detail improvements. That means powerful, reliable custom engines have never been easier to find and are excellent choices for your flying project. Educate yourself on what those engines need in regards to installation and operation by the pilot and they’ll be there for you.

The bottom line? No one knows where the fuel situation is headed, but insiders aren’t shaking in their boots that the 100LL engines are going to be obsoleted. Certainly huge forces are afoot for unleaded gas and diesel, but the economics of thousands of existing gas burners can’t be denied. As Lycoming’s CEO Michael Kraft puts it, “Diesel engines are going to be more expensive and use less fuel. Consumers will have options.”

The Traditional Basics

Today’s mainstream Experimental aircraft engine builders center around Lycoming and, to a lesser extent, Continental powerplants. These two engine companies have been around since before WW-II, and indeed, their horizontally-opposed engine designs are easily traced in principle to pre-war powerplants. For decades Lycomings and Continentals were built strictly for certified aircraft, with homebuilders marrying the existing engines to their homegrown airframes as necessary.

As Experimental registrations came to surpass certified new aircraft sales, Lycoming embraced the Experimental market. Reaching into their extensive pile of engine parts, they’ve been able to mix-and-match their existing bits with newly-developed parts to arrive at new engines specifically for the Experimental market, and not certified for use in any “store-bought” airplane.

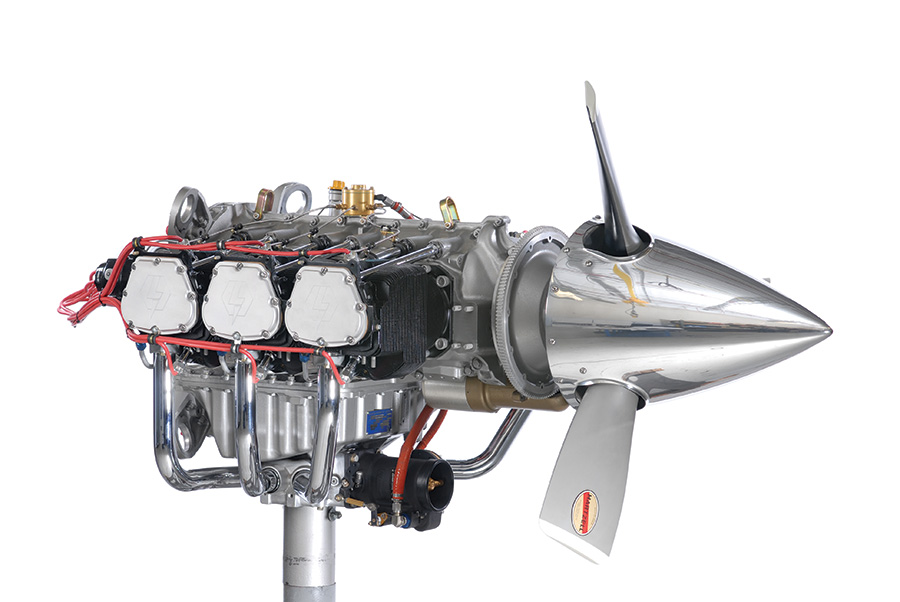

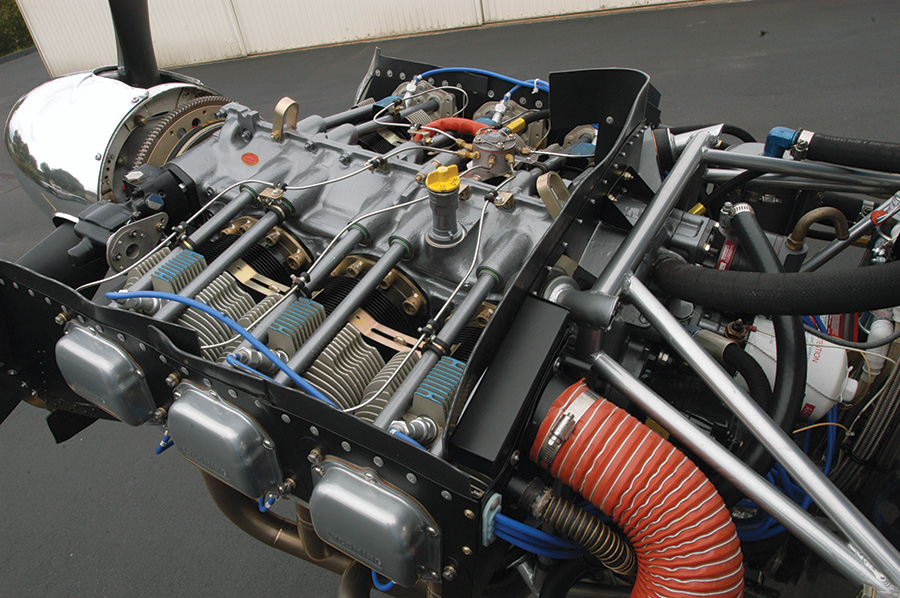

If Lycoming makes it, their in-house custom shop, Thunderbolt, can make it better. This Thunderbolt cold-air sumped 540 is similar to the Thunderbolt engine Red Bull air racers will fly this year, yet the same shop is just as happy customizing an 0-233 LSA engine.

In the case of the overwhelmingly popular RV series from Van’s Aircraft, Lycoming has even developed specific engines for RV airframes. In an ironic twist, these Experimental engine and airframe combinations are easily the numeric norm in new general aviation aircraft builds, so they hardly seem “experimental.” But legally, of course, they are.

The result is Lycoming now sells engines in certified, Experimental, engine kit, and Thunderbolt form, while Continental sticks almost entirely with certified sales. It’s important to understand a certified engine is specifically defined by FAA regulations. While there’s nothing stopping you from modifying one to make it work on your homebuilt, it won’t remain a certified engine if you do. Instead, it will become an Experimental engine. That’s fine on an Experimental airframe, but if you ever want to sell the engine, its resale value could be diminished because certified aircraft owners can’t use it.

Also, certified engines are certified with specific propellers. If you preserve the certified prop/engine combination when installing it on your Experimental, you’ll have the peace of mind that vibration ranges harmful to the propeller have been eliminated—or at least identified so you can avoid them.

There’s a reward from the FAA, too. Certified engine and propeller combinations typically receive shorter flight-test phases—normally 25 hours for certified combinations versus 40 hours for Experimental engines.

An odd twist with certified engines is—aside from regular maintenance such as sparkplug, oil, and filter changes—you won’t be able to legally maintain it with just a repairman’s certificate. That’s a job for an A&P, as long as the engine maintains its certified status. But then, you weren’t planning on much more than oil changes.

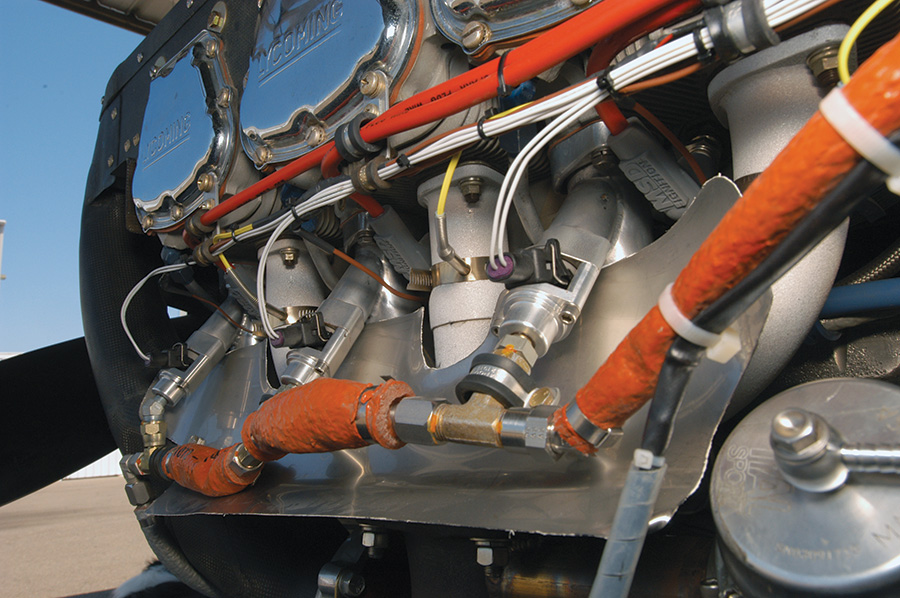

Some bemoan general aviation’s “antiquated” engines, but really, the core engines have been well updated over the years by their makers. It’s the engine management—spark and fuel control—that’s lagging. At least you can do something about that, such as fitting this scratch-built, computer-controlled EFI fuel system.

More to the point, certified engines go straight for the wallet at purchase time thanks to their nearly lawyer-proof paperwork. This makes them a distant second choice in the real homebuilding world. Most new certified engines sold for Experimental airframe use go overseas where onerous local regulations require government approval. Should you choose the certified route (not that rare when buying a used engine), you should have minimal maintenance issues and enjoy a slight bump in resale value. That and maybe a modicum of liability protection should you sell it.

Kits & Clones

Imitation being the sincerest form of flattery, the popular 4-cylinder Lycomings have spawned a thriving aftermarket from Engine Components International and Superior. Both companies started by producing replacement parts for the popular Lycomings, and both have reached the point where they can produce entire Lycoming-based 4-cylinder engines, popularly known as clones.

Clone engines—and the parts they are made of—can even be legally used as replacement parts for certified Lycoming engines, and you’ll find ECi and Superior parts throughout custom engine shops alongside Lycoming bits. This is a big plus for engine consumers, as competitive pressure from ECi and Superior keeps prices in check.

ECi and Superior have also proven eager to respond to homebuilder demands for larger displacement “stroker” engines. These are purely Experimental engines and are currently all the rage with mainstream homebuilders—RVs—because currently everyone seems to want “just a little more.” The strokers deliver that extra torque in a dependable package, but it definitely costs more.

Gather all the parts for a clone or genuine Lycoming or Continental, put them in a couple of boxes, and you have an engine kit. It’s just what it sounds like—all the major pieces needed to assemble an engine are included, much like a comprehensive airframe kit has all the major parts needed to assemble an airframe. But unlike airframe kits which are bought by individuals and assembled at home, engine kits are mainly purchased by engine shops and assembled by their pros. They find them a cost-effective way to build a customer’s engine from scratch, something that’s common as good, usable core engines are in relatively short supply these days.

Homebuilders can assemble their own kit engine, but for the typical airplane builder it is more work to do, is usually not high-interest enough, can be intimidating, and requires a few special tools (degree wheel, for example) to do right. But if you’re an experienced engine person and don’t mind the work, it might save a few dollars.

Custom Shops

In this age of rapid communication and near-universal exposure on the Internet, it seems that having a good, stock engine is not quite enough for many of us. Whether it’s nothing more than a custom painted crankcase or specialized accessories, higher compression for increased fuel economy or high-altitude back-country work, there’s a definite demand for something special under the cowling.

When working with a custom engine shop, you can stay as involved as you want. These shops welcome interested customers and are happy to pass along their knowledgeable advice. They do great work too, as with this 300+ hp 10:1 AEIO-540-EXP from Ly-Con.

Where such requests end up being fulfilled is in a relatively small, but well-known group of engine shops. Good examples are Aero Sport Power, Barrett Precision Engines, Eagle Engines, and Ly-Con Aircraft Engines. These shops are right in the middle of the airplane engine universe because all of them can do everything from sell you a factory-new Lycoming or Continental to overhaul an existing certified engine, overhaul an Experimental engine, build an Experimental engine from scratch, or from a pile of parts you walked in the door with. All of these shops are amazingly well-versed in their business of supplying powerful, dependable engines in the Continental and Lycoming architecture.

And yes, Lycoming’s Thunderbolt line is a direct competitor to the independent custom shops. Its corporate ties typically make it a little more expensive, but you can say it came from Lycoming if that helps.

Working with a good engine shop is a value-added proposition in that they have the knowledge, parts, and flexibility to get you the engine you want at competitive prices. Typically they also provide a wider range of services such as O-ring case sealing or dynamometer break-ins that a catalog sale can’t offer.

When cooling counts, a plenum system is the most efficient for your new engine investment. For max cooling from minimal inlets Reno racers all run plenum cooling. Typical of current practice, Steve Temple’s Madness directs plenum air over the cylinder heads and barrels, bypassing the crankcase, which is 100 percent oil cooled.

These shops tell us their business is fairly evenly split between certified overhauls and Experimental work, so they’re fully invested in aviation safety standards. But they are also free to tinker with their Experimental engines, so they’ve developed little tricks—upgraded parts and procedures Experimental customers appreciate.

Trends: Rollers, Strokers, and Domes

As you mull your engine purchase options, you’ll find roller lifters, larger-displacement stroker engines, and higher-than-stock compression ratios continue to be the hottest technical topics in engine sales.

The major benefit of roller rockers is relief from rusty cam worries (see sidebar). The friction reduction inherent in a roller lifter is helpful in freeing up a few extra ergs of power and reducing oil heating, but these are minor effects you won’t feel. Not having the lifters go flat and filling the engine with metal filings is their real advantage.

Stroker engines are larger displacement versions of existing powerplants arrived at by fitting a crankshaft with a longer stroke. An O-320 becomes an O-360 and an O-360 becomes a 390 or 400. They’re very popular because they deliver more torque and horsepower in an engine no physically larger than their parent engine with seemingly little downside. Actually there are pipers to pay in increased friction and thus reduced TBO, but given the low-rpm nature of these engines and how little we all fly, it’s not much to fret over in the real world.

More practically, strokers are more expensive to purchase and feed. The first issue is between you and your need for speed (or rate of climb in real-world terms), and the second is sort of a minor gift that keeps on giving. That said, strokers provide power levels—and weight savings if you look at it that way—that fit between the traditional 320, 360, 540 cubic-inch steps.

Higher compression ratios fundamentally increase engine efficiency. It’s then up to the pilot to extract this increased efficiency as either more power or fuel economy. The power is handy for better climb performance, then once up high the higher compression literally means more bang for the power stroke buck. So either less throttle is needed for the same power, or more power is made at higher altitude. The latter gives more miles per gallon due to reduced aerodynamic drag at the higher altitude.

Higher compression is achieved by fitting pistons with taller domes. No modifications to the cylinders are required, and all said this is a cost-effective modification. Because the same balance is maintained with the aftermarket pistons, they can be swapped out later if fuel octane concerns come true.

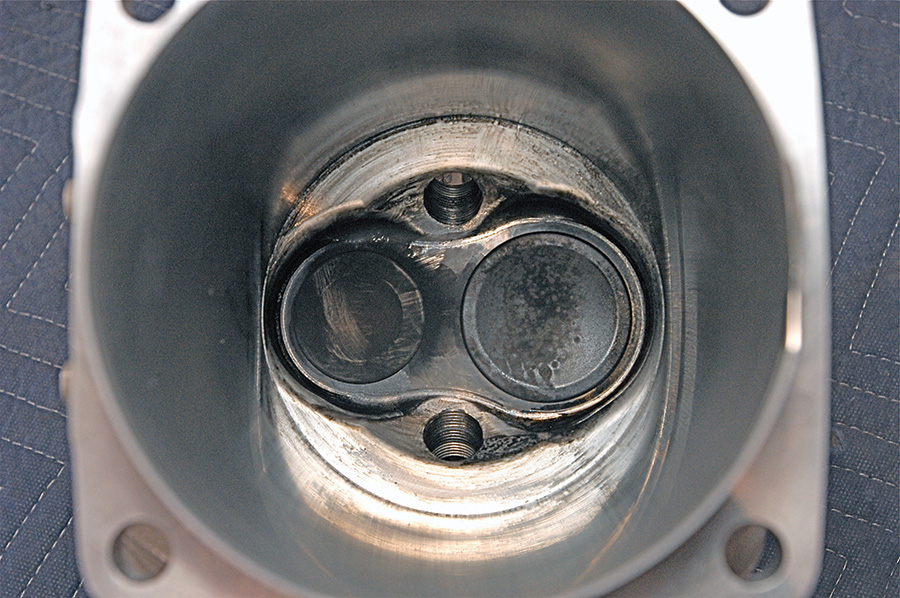

Other considerations are increased loads on the bottom end and more rejected heat to the cylinder heads and especially the oil (which cools the bottom of the harder-working pistons). Lycoming and Continental have no real love for this mod, noting their engines are designed for a certain level of stress in the crankcase, but the custom shops have meaningful experience with it and report no issues. In fact, 10:1 seems to be the new 8.5:1 in these shops.

With Power Comes Responsibilities

One reason it’s fairly easy to increase power and efficiency in legacy Continental and Lycoming engines is most of them—especially the low- and mid-level parallel valve performers in the naturally-aspirated 290 to 360 cubic- inch range (and 540s)—were designed with healthy reserve margins of strength and heat rejection. This makes tottering around in something like an older Cessna 172 a largely brainless affair when it comes to engine management. Taking off with cold oil, sudden power reductions and steep descents, relying on old, wasted baffle seals and low efficiency oil coolers can largely be gotten away with because the engines have plenty of mass and strength for the modest loads they generate.

Increasing cylinder pressure and temperatures with higher compression or increased displacement means some of those reserve margins are consumed, and the pilot and mechanic absolutely must give the engine more consideration if something close to the same engine lifespan is expected. Oil must be warmed up before take-off every time; baffle seals and coolers must be operating effectively, sufficient cowling openings and exits must be provided, and so on. It’s something to keep in mind when considering a hot-rodded engine.

Fine Time To Buy

So, if you’re ready to power your homebuilt, there are many dependable, well-sorted choices readily available. These include those engines commonly used in smaller planes, such as the Rotax and upcoming UL Power series popular in LSA aircraft.

We must acknowledge the possible market shift from a change in avgas, but it’s no reason not to buy an engine now. An engine bought today will be relevant for decades to come as technological solutions already in place can smooth foreseeable transitions.

Besides, one should never not fly today in fear of tomorrow.

Individual Engine Makers

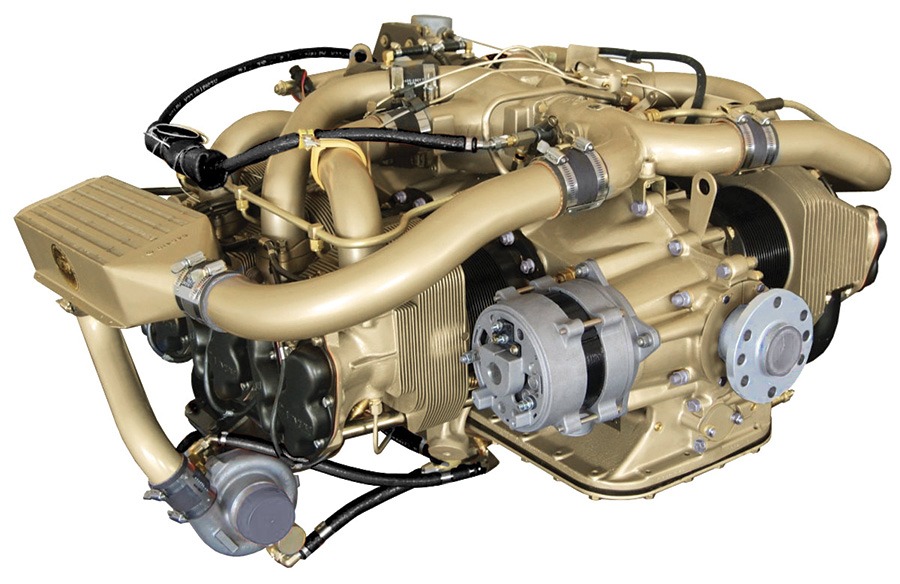

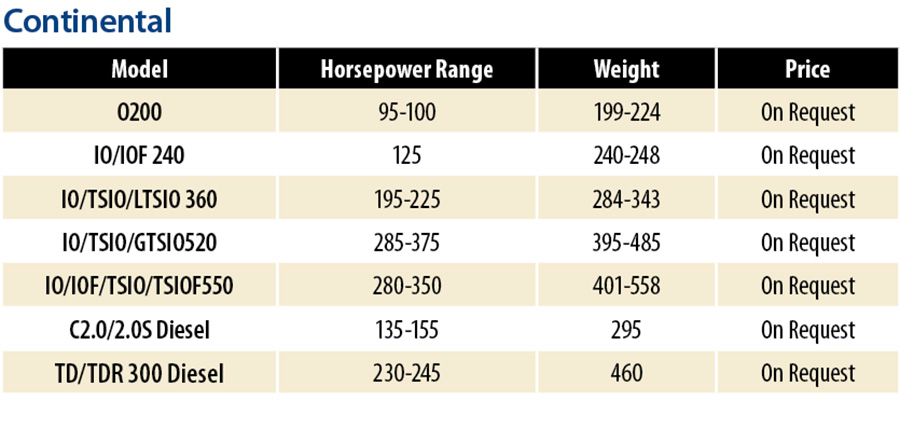

Continental

Innovative is a good word to describe Continental’s Experimental engine offerings. On sale now is the O-200 Lightweight Aviation Engine for LSA use. It’s the venerable O-200 that’s powered legions of Cessna 150s and the like for decades, but reengineered and put on a diet to compete with the Rotax 912. The Continential is still about 75 pounds heavier, but at a rated 75 hp at 2500 rpm it should outlast granite.

Willing to try new technologies (recall the water-cooled Voyager, high-speed Tiara, and first-to-market FADEC initiatives), Continental has put the financial muscle of its Chinese owners to use in its bid for diesel power. The plan is to grow from its U.S. centric business model and establish itself as a worldwide engine builder. Notably, Continental has bought German diesel engine manufacturer Thielert outright, plus the rights to build one of French company SMA’s diesels. The result is the Centurion line of 2.0-liter diesels (the ex-Thielert engines) and the mid- to large-size SMA-derived 230 hp TD300.

Let’s emphasize that Continental is not abandoning its mature 100LL gasoline engine business by any means. New and rebuilt O-200, -470, and -550 engines and parts remain in production, with Continental’s Alabama facility a good source of factory rebuilt TSIO-550s for the go-fast plastic fantastic kit builders.

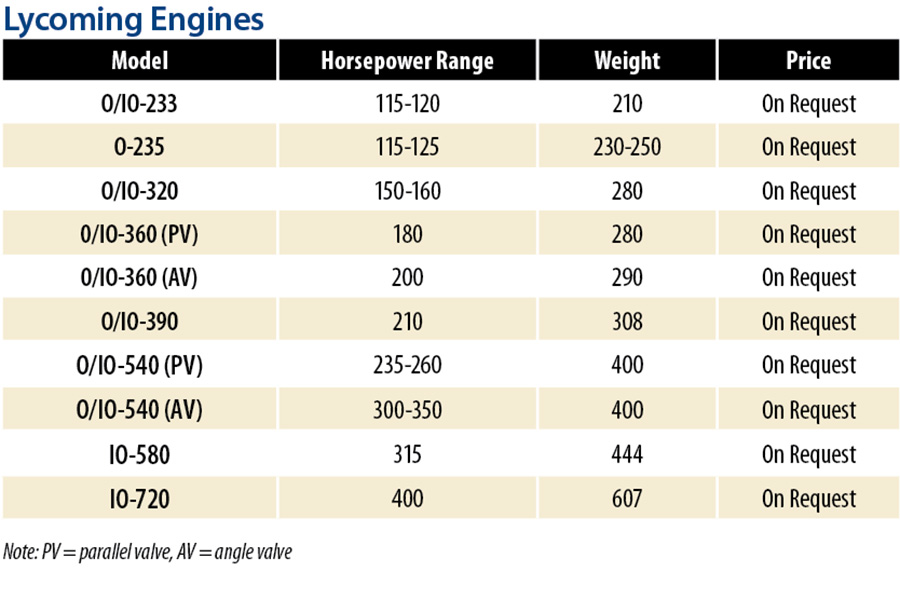

Lycoming

Experimental engines from Lycoming are numerous and stream from the Williamsport, Pennsylvania factory from either the main production line or the niche Thunderbolt custom shop. All of these engines are derivations of Lycoming’s

certified engine line, and thus range from LSA 4-bangers to an IO-720 flat-8 if you need that much engine.

Bling can be big at Thunderbolt, as this patriotic 390 illustrates. This could just as easily have been one of Lycoming’s newest IO-233 engines, which is now flying in a Corvus Phantom. The IO-233 is designed for low-octane mogas and features dual CDI ignition.

Lycoming reports the Thunderbolt shop has been a strong success for the company. A standout seller is the IO-390; it’s estimated that half of these are going into new RV-7s and -8s.

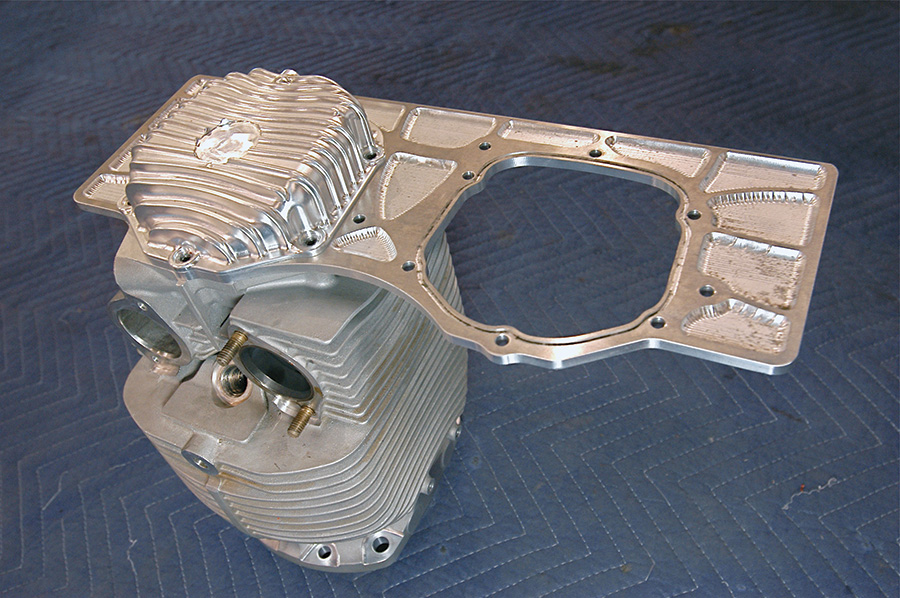

Two-man teams assemble each Thunderbolt engine start to finish, and with Lycoming’s size, it’s easy to add or subtract personnel to or from Thunderbolt production as needed, so there are no volume constraints. Regular Lycoming parts are used, but fitted with tighter tolerances, and the cylinders are all ported. Custom engine paint and chrome trim are standard on Thunderbolts, and Lycoming’s huge accumulation of sumps, intakes, and accessory locations are all available. Thunderbolt buyers have their choice of aftermarket accessories, too, such as Airflow Performance or Precision Airmotive fuel injection.

Thunderbolt engines are offered in Signature, Extreme, and Competition trim. Signature is the standard performance Thunderbolt with a 2-year, 200-hour warranty while the Extreme engines boast power boosters such as higher compression, along with a 1-year, 100-hour warranty. These are by far the most popular Thunderbolts; the Competition engines are full-race units and un-warrantied.

One change is Thunderbolt engine kits are no longer offered—they were overpriced for the market and we sense Lycoming was never comfortable with the liability exposure of amateurs assembling their engines. So, all Thunderbolts are fully assembled at the Lycoming factory.

A coup for Thunderbolt is that Red Bull chose them to supply AEIO-540 EXPs as the spec engine for the rejuvenated Red Bull Air Race World Championship this year. These are 10:1 compression engines using D-series cylinders and the L1B5 bottom end to facilitate cold air induction. Aside from electronic ignition and a propeller governor pad, their only accessory is a backup alternator on one of the magneto pads.

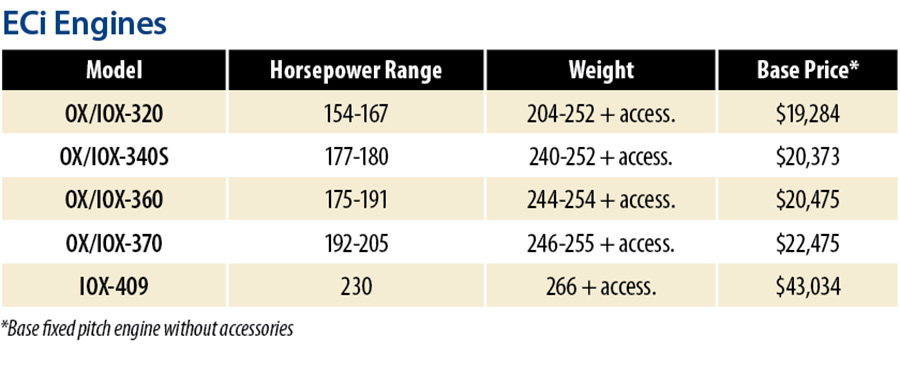

Engine Components International (ECi)

ECi has been in the aircraft engine and parts business since 1943, and their Titan EXP line of Experimental engines is understandably mature. Newest of the bunch is the IOX-409 which uses Lycoming 360 architecture (but all ECi parts) with a custom long-stroke crankshaft and stock bore ECi Titan cylinders. It’s very much a performance engine, rated at a muscular 230 hp right out of the box. Only a couple are flying at the moment and, with a premium price, it is not designed to be a high-volume seller, but it is a stand-out, off-the-shelf performance offering. Highlights include 4-bolt connecting rods for stiffer bearing support and lightweight slipper-type pistons with a 10.5:1 compression ratio.

Much more popular is the 370 stroker, which is the step-up engine from the stock-stroke 360 4-cylinder for all those RV-7 and -8 builders. It is ECi’s most popular EXP engine.

ECi’s stroker 0-320 is the 340. It’s now the original-equipment engine for Cub Crafters, which shows just how popular the stroker engines have become. All of ECi’s engines are flat-lifter designs with nitride hardening of the lifter faces and oil squirters in the crankcase to assure rapid lubrication at engine start-up.

Likely the biggest development for ECi is they can now assemble and dyno break-in their engines in-house at their San Antonio headquarters. ECi still sells engine kits, but has found customers overwhelmingly go for the fully-assembled, run-in option. There’s still plenty of choice in all this; ECi prides itself on being flexible to customer needs, offering five engine paint colors as standard choices, for example. Due to the many available options, ECi recommends calling their sales team to receive an accurate price for a specific engine configuration.

Still in the works is an ECi 540 Lycoming-based engine. This has been a multi-year project, but we sense some progress has been made, although the engine coming to market in 2014 is by no means assured, or even probable. Still, ECi sees a market for their own 6-cylinder case and crankshaft. This will eventually provide welcome pressure on 6-cylinder parts prices if nothing else.

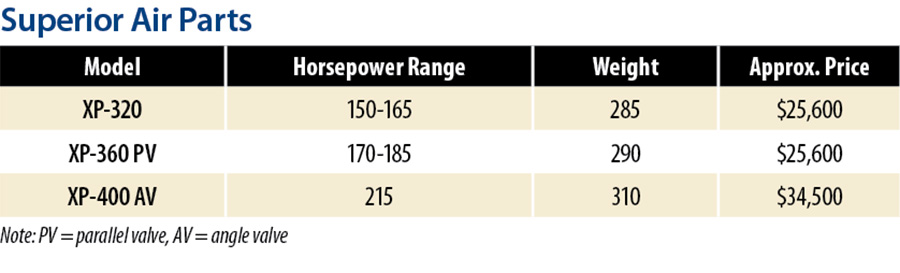

Superior Air Parts

Superior got its start in 1967 with nothing more than offering one part number, a valve guide, but today they are one of the major players in the Lycoming parts and clone business. Using their own parts, they are able to produce complete 320 and 360 engines, plus a 360 stroker measuring 400 cubic inches.

Given the current fashion for displacement and power, the XP-320 is mainly sold to RV-9/9A builders, while the XP-360 goes on almost everything else. The XP-400 is a healthy jump in power from the 360, but definitely more expensive, so you must truly want to beat your buddies to breakfast or have a high-altitude or heavy-lifting need.

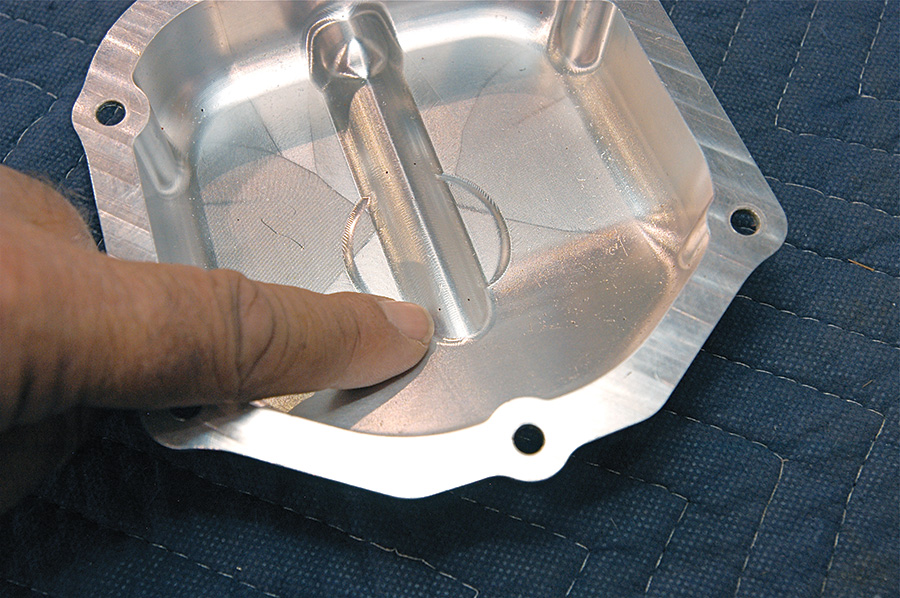

Superior’s stroked XP-400 is a good representative of the trend to power in kit aircraft building. Fuel injection on a forward-facing cold air intake is the sole induction choice; perfect for the intended RV-7/8 market. A dynamically counterweighted crankshaft allows more latitude in propeller choices.

Also worth noting, the XP-400 is an angle valve engine, so it weighs 20 lbs. more as well. All XP-400s are fuel injected, using a forward-facing throttle body and a cold-air sump, roller lifters, your choice of front or rear prop governor pad, and a counterweighted crankshaft. The engine is sold with magnetos; electronic ignitions are optional. Besides Superior, Aero Sport Power and Barrett Precision Engines have been approved to build this engine using a Superior kit.

From another perspective, because the 400 is the same size and weight, but 15 hp more powerful, Superior has dropped last year’s XP-361. One thing regaining momentum at Superior is their engine build school. This is where customers pay $1,000 over the price of an assembled engine to actually assemble their own engine at Superior’s Texas headquarters. About 15 people a year (and growing) make the two-and-a-half-day investment; Superior says these customers report high satisfaction in knowing what’s inside their engine.

A separate bit of news is Superior admits to working on a new engine—a 4-cylinder—that will hopefully come to market in 2014, so we’ll keep an eye on what they’re up to.

Finally, if you’re wondering if Superior’s Chinese ownership means Chinese parts, that’s not so. Superior’s business model is to scour the production community in North America and Europe for the best sources for each part (a crankshaft specialist does the cranks, another shop does the pistons, etc.). This leads to “a ton of vendors!” but curiously there’s not a single Chinese-sourced part.

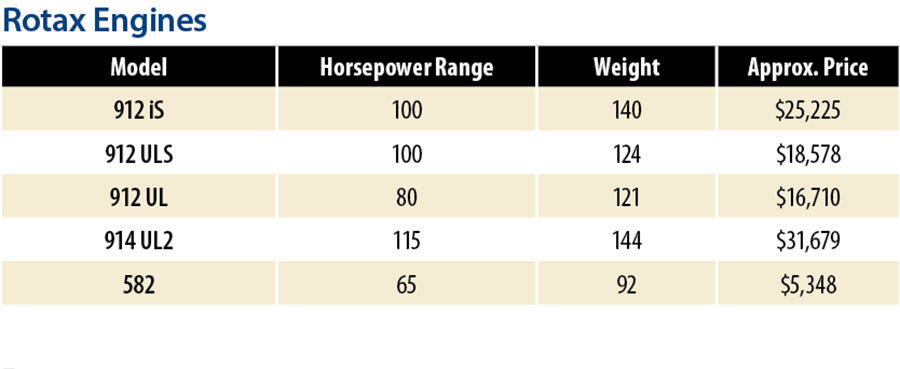

Rotax

The go-to engine in the LSA and compact homebuilt markets, Rotax has made impressive inroads into mainstream sport aviation. In fact, Rotax claims 88% of Light Sport Aircraft are Rotax powered.

Last year the familiar dual-carbureted, water-cooled Rotax 912 gained an intramural brother-in-arms with the electronically fuel-injected 912 iS. It’s more expensive and doesn’t advance the power-to-weight equation, but does more with a gallon of mogas. Rotax says flight training outfits report a stunning 30 percent fuel savings, and if you hoof it up to 8000 feet, it gets 36 percent more mileage than the carbureted 912 S. This is enough improvement that even with a $6,500 price premium, the electronic 912 iS is proving popular with over 400 delivered in its debut year. Pilots are apparently appreciating the computerized single-lever power control that delivers rich-of-peak fuel near full power, then automatically drops to lean-of-peak operation at 97 percent power or less. In fact, 912 S sales seem unaffected by the popularity of the 912 iS, which we take as a show of strength in LSA building.

A new aspect with the 912 iS is electronic troubleshooting. The engine computer data logs and files can be e-mailed to Rotax’s distributor for analysis. This has been a help with the inevitable installation issues as the market gets used to installing the EFI engine.

All Rotax engines are well supported with easy parts accessibility through California Power Systems (wholly owned by Aircraft Spruce) and a strong technician training program that’s already made this third rail of aviation engines a mainstream commodity.

UL Power

This interesting line of modern engines from the Belgium UL consortium continues to build exposure in the United States. Going head to head with Rotax on many fronts, the UL Power engine family couples the simplicity of air-cooling and direct drive with the sophistication of electronic engine management. Their engines are thus lightweight, definitely competitive on performance, and get good fuel efficiency while exhibiting commendable workmanship.

The challenge is getting a population of proven high-time engines to judge real-world, long-term durability. UL Power has enjoyed a growing legion of happy installations in Zenith, RANS, and other airframes in the last year, with the highest-time engines in the 400-hour range as we went to press. So, while long-term durability remains impossible to judge from this young company, the 4-cylinder 260 and 350 engines have already proven themselves fine performers in several airframes and a smaller number of 390 and 520 6-cylinders seem to be doing the same.

UL Power maximizes commonality among their engines with piston stroke and compression ratio the defining differences. Cylinders are identical throughout, along with everything else that could be, such as fuel injectors, valvetrain parts, etc. All engines are designated “i” because all are electronically fuel injected. The “S” engines have higher compression ratios and the main displacement designation covers differences in stroke. The 260i is therefore the shorter-stroke low-compression engine, the 350iS is the long-stroke, high-compression variant. The 260 and 350 engines are 4-cylinders, the 390 and 520 are 6-cylinders.

Not shown on the chart are a limited number of helicopter and aerobatic (inverted oil) versions.

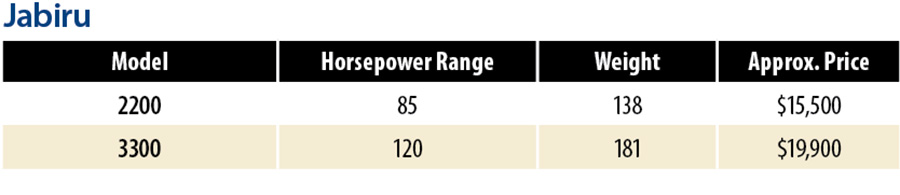

Jabiru

Currently celebrating their 25th year, Jabiru is an Australian company with a focused concentration on keeping their aviation engines simple and light. In fact, there are just two Jabiru powerplants, a 4-cylinder 2200 and a 6-cylinder 3300. The major difference between them is the number of cylinders, with everything else that can stay the same staying the same.

Simple in the extreme and offering some of the most affordable horsepower in aviation, there’s no missing a Jabiru with its towering cylinder head fins. At 120 hp this 3300 Jabiru will make a spritely performer in the waif-like Sonex.

Jabiru has fully embraced CNC machining, with just about everything in the engine whittled from aluminum billet. Air cooling and direct drive keeps things lightweight, as does a simple, fixed-timing flywheel trigger ignition with automotive spark plugs. No electrical system is needed, and both Jabirus burn 91 octane mogas or 100LL.

Years ago there were cylinder head overheating issues, but Jabiru has redesigned the cylinder heads with considerably more cooling fins and the issue seems long gone. Even so, Rotec (another Australian company) offers an aftermarket water-cooled cylinder head for the Jabiru if you are so inclined.

U.S. sales and service are handled out of Tennessee by Jabiru Sport Aircraft. They’ve developed a large number of firewall forward kits to speed Jabiru installations on Zenith 601, 650, 701, 750; RANS S6, S7S, S19; Van’s RV-12, Kitfox, Avid Mk 4, and the Arion Aircraft Lightning. Prices for the FWF kits vary, but hover around $4,000 and typically include a battery and carb heat boxes, fixed-pitch prop, spinner, oil cooler, and cowl.

Hirth

News from the storied German ultralight engine maker is the popular 2-cylinder F23 is now the F23 LW or “lightweight.” The crankshaft, flywheel/generator, and recoil starter are redesigned for reduced weight, while the power remains at 50 hp. Now scaling just under 49 pounds without muffler, the F23 LW can be had carbureted or with electronic port injection. With the many options available (electric starter, diaphragm or slide carburetors, electronic fuel injection, centrifugal clutch, belt gear reduction) you’ll need to contact Hirth for pricing; orders are filled from Germany and take 4–6 weeks.

MW Fly

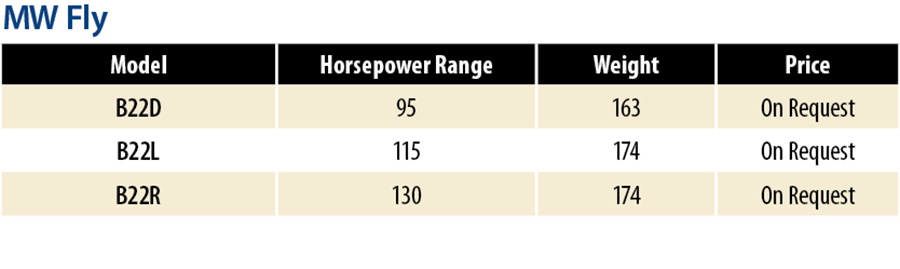

A brand new Italian company, MW Fly was showing its equally new Aeropower B22 4-cylinder at AirVenture last year. MW Fly says the clean-sheet design has been running on the dyno since 2004 and first flew in 2006. The horizontally opposed boxer is water cooled, overhead cam with 2-valves per cylinder, and boasts integrated electronic fuel injection and ignition systems with dual engine control computers. Several engines are planned, most with gear reduction and ranging from 95 to 150 hp. Displacements span 2.0, 2.2, and 2.5-liters. Either mogas or 100LL can be used with MW Fly saying the 130 hp version burns about 5 gph at 75 percent power.

Matching engine monitoring instrumentation is by P.A.T. Avionics; Bush Caddy of Canada is currently offering the engine and instrument package in North America.

At press time the naturally-aspirated 150 hp 2.5-liter B25R was flying in a Bush Caddy on this continent. By 2014 MW Fly is planning turbocharged and right-hand rotation versions. Current MW Fly engines turn to the left from the pilot’s point of view. A helicopter version with clutch is also planned.

MW Fly said in late 2013 that almost 100 engines and instruments had been sold and approximately 70 of them are flying in Europe, Russia, and South Africa.

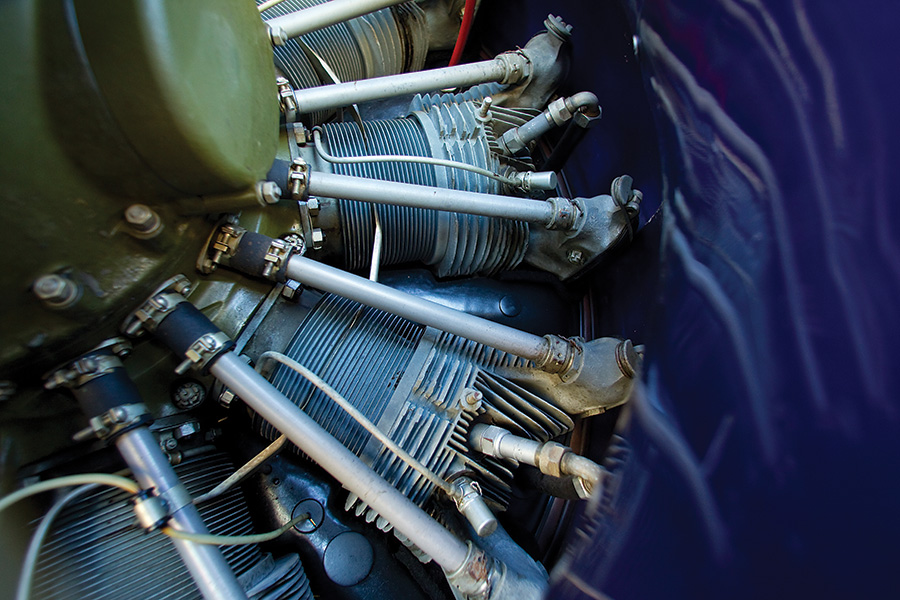

Round Power

People like to say there’s a gap in the 350 to 650 hp range, and generally they’re correct. But the Russian designed, Romanian built Vedeneyev M14P is readily available in the U.S. and plays a measurable role in the aerobatic community. To homebuilders it’s the thundering torque monster behind the Pitts Model 12, and to Model 12 builders, Barrett Precision Engines is one of the most visible proponents of these robust engines (Motorstar NA is the primary importer). We’ve documented the improvements Barrett has made to the M14P previously, so we’ll direct your technical attention there. But for this buyer’s overview, we’ll note Barrett is still developing this powerplant. They report completion of their electronic ignition, plus recent success in repeatedly tuning hopped-up M14Ps well into the 400 hp zone. A mildly warmed up example cited as we went to press dynoed at 424 hp, for example. That will fairly turn a Model 12 Pitts into a helicopter, as it’s nearly a 1:1 thrust ratio given the M14P’s massive torque and affinity for big paddle-blade props.

Barrett says a simple overhauled M14P with carburetion, new 3-ring pistons, and no ignition is about $34,000 while a fuel-injected, electronic ignition model is just under $47,000.

For compact homebuilts, say a Kitfox as we featured in 2011, the Australian-built Rotec radial delivers the heart-melting nostalgia and elegance of round power on an affordable scale. There are two versions, the more popular and easily obtainable 120-hp 7-cylinder R-2800 and the 150-hp 9-cylinder R-3600. Both are single-row, geared, carbureted units. Built in batches, it pays to order these engines earlier in your build to avoid shipping delays.