Engine development has always occurred slowly in aviation. Innovation costs money, big money, and there’s not much left over when an engine company counts its profits at the end of the year. Since late 2008, the economic realities have been harsh: The original-equipment market has shrunk dramatically as new certified airplanes are fewer and further between.

Lets not misunderstand the dynamic. When Continental and Lycoming are healthy, supply lines are full and the prices are moderate; in tough times engine production is likely to be curtailed, and prices go up. Simple economics. Homebuilts, by themselves, aren’t a large enough force to significantly influence the market. Were a nice additive in sales, but we don’t have the horsepower, as it were, to spur the development of new models or technologies.

Together with that economic reality is the fact that kit manufacturers are themselves quite conservative. To create a new firewall-forward kit the right way requires fitting a company airplane with the next-generation engine, flying extensively to vet the installation and then finding a way to profitably build the FWF components. When the engine manufacturer is new, small or foreign, the kit maker faces the prospect of becoming technical support as well. Its not a job many kit companies are staffed to take on, nor do these engine-outreach programs contribute much to the bottom line.

So the result is continued orthodoxy. We know what works, with a minimum amount of effort on the part of the kit maker and the builder, to provide the greatest chance of any homebuilt proceeding from a pile of parts to an actual flying airplane. This is a long-winded way of explaining why this years Engine Buyer’s Guide strongly resembles the one we published last year.

Corporate Culture

Changes in the industry help shift corporate focus. Teledyne Continental Motors has been purchased by a Chinese company, AVIC International, and at press time the fallout from that change of ownership had not taken place. The company in Mobile, Alabama, has been lukewarm to the Experimental market, though new management likely to arrive with the sale might change that outlook. For us in the homebuilt world, Continentals offerings are few, and they’re provided only through kit makers or as field overhauls by independent shops.

In the last year, Continental has also purchased the rights to develop the SMA diesel engines, and it continues to do so with sales to certified ships as the exclusive goal. Continental told us outright it was not interested in pushing the diesel into the Experimental market just yet. Our best guess? The engine isn’t developed to the company’s satisfaction, and it would benefit from a lot of time on the front of the company’s Cessna 182 test mule.

Lycoming is busy pushing the development of its IE2 electronic engine management, assisting in the research for a lead-free replacement for avgas, and turning the crank on the IO-233 program to get a lightweight version of the venerable O-235 into the LSA market. Lycoming is continuing direct sales of its Thunderbolt line of Experimental engines, though the smaller shops have been doing well selling versions of Lycoming kit engines, which are essentially all-new engines delivered in pieces and assembled to order.

Lycoming IO-540.

A diesel from Williamsport? Don’t hold your breath-company general manager Mike Kraft publicly stated that the weight issues inherent in a compression-ignition engine cant be overcome by its intrinsic efficiency benefits.

Which Is Which?

Following a process we began last year, our engine buyers guides are separated into two groups. This months will look at what we loosely term the conventional engines, though this category has grown to include smaller, newer manufacturers than Continental and Lycoming. As a general rule, we have broken out engines that were designed from the start to be aircraft powerplants, thereby demarcating the line between them and engines that started life under an automobiles hood. Yes, this is a blurry line…we know. Engines like the AeroVee, based on the mighty Volkswagen, have evolved sufficiently and are now specialized enough that they almost inhabit their own world, but we have only so many pages. Well take a closer look at so-called alternative engines next month.

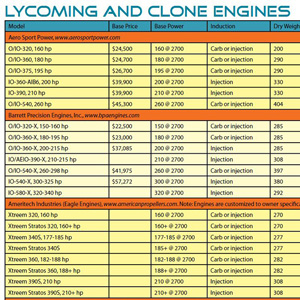

Lycoming and Clone Engines

For reasons of price, weight and availability, the Lycoming four- and six-cylinder engines have been the overwhelming favorites of a large segment of the homebuilt market, though that market is being eroded from the bottom, in a sense, by the number of Rotax 912s loosed in the world every year.

For the modern homebuilder, the Lycoming choices come down to finding a serviceable engine to use as-is or to rebuild or to buy new. For the latter, the options include obtaining a new, standard-issue engine directly from your kit manufacturer through whats called an OEM (original equipment manufacturer) arrangement. OEMs buy engines in multiples at a discount from the maker, and pass some of those savings onto you. For the most part, these OEM engines are just like the ones that might have gone into a Piper Archer or Cessna 172. For many builders this is the safe, comforting route.

But thats not enough for some. Today, as has been true for the last three years, the further options involve Lycomings direct engine line under Thunderbolt, having one of the few approved shops build a Lycoming kit engine, or putting your money down with an independent builder to create an engine from various sources.

Before the collapse of Superior, this engine builder had the option of components from Superior, Engine Components, Inc., and Lycoming itself. Much the same is true today, save for the fact that Superior is not yet up to creating whole engines-it expects to finally begin deliveries of whole engines this spring (see Around the Patch, Page 2). So when you approach an independent engine builder, you are asking him to build you an engine, and his raw materials are all-new parts from Lycoming (essentially soup to nuts), new parts from ECI (same deal) or a mix-and-match combo using some of both stirred in with a few of the pieces Superior is making.

The Lycomings on your radar will likely come from four basic families-the 235 series, the 320/340/360 parallel-valve group, the IO-360/390 angle-valve bunch, and a brace of six-cylinder 540s, in both parallel-valve and angle-valve configurations.

The O-235 series is a small, four-cylinder model that is related to the O-290, which shares the 3.875-inch stroke but uses a larger bore. With a 4.375-inch bore, the O-235 produces from 100 to 125 hp, depending upon specification. The lower-rated models have a 6.75:1 compression ratio; at the maximum 2800 rpm, this is a 115-hp engine, but can be derated by limiting max speed. Middle models have an 8.5:1 compression ratio and make 118 hp nominally, or an 8.1:1 ratio at 116 hp. The performance variant has a 9.7:1 compression ratio for 125 hp.

Up the ladder is the 320/360 series, which also includes the O-340 once upon a time-an engine that ECI resurrected several years ago. They’re all modular, kids. Sharing a 5.125-inch bore, the three displacement versions vary by stroke, from 3.875 in the 320 to 4.375 in the 360. Bear in mind that stroke in an opposed engine also influences installed width; a kit designed around a 320 might need cowling cheeks with a 360. OK, so they’re kissing cousins, but be aware that there are dozens of permutations in the 320/360 world, and it might not be possible to update a low-compression (7.0:1) O-320 to 160 up (with 8.5:1 compression) because of other factors like bearing size.

To create even more confusion, the angle-valve four-cylinder engines with the same displacement (360) can be different animals. They have larger heads with higher stock compression ratios and produce more power. The older IO-360-A makes 200 hp, while its more recent brother, the IO-390, turns out 210. The 390 is a big-bore (5.319 in versus 5.125) iteration with slightly higher compression (8.9:1 versus 8.7:1). Because of the cylinder design, the angle-valve engines are wider than the parallel-valve versions of equal stroke, and are heavier, typically 20 to 40 pounds more.

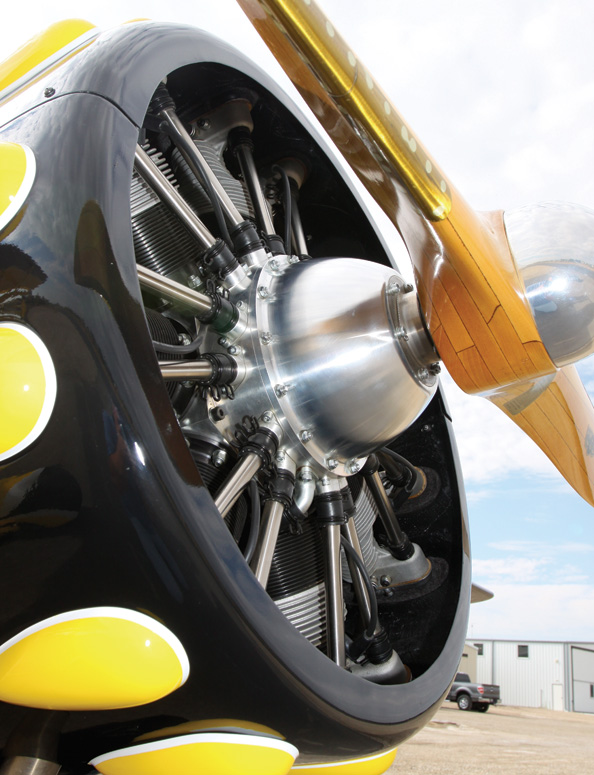

The sixes follow the four-cylinder format, with the O-540 parallel-valve engine topping out at 260 horsepower, and the angle-valve IO-540 capable of up to 310 hp normally aspirated, and 350 when turbocharged.

And what of those fancy-schmantzy roller cams? You might remember that Lycoming began switching its entire line from conventional flat tappets. Field reports continue to be positive, which means simply that if there is a widespread failure mode, we haven’t reached the threshold. Lycoming was bullish enough on the technology to switch nearly all of its engines over in one fell swoop, so their engineers must have known something.

Continental O-200.

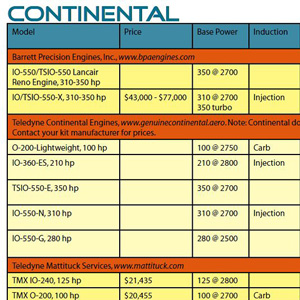

Continental Engines

Continental has three basic families available to the homebuilt set, one in steady development, one in aggressive development and one nearly dormant. The engine going the way of the dodo is the IO-360 six-cylinder, which is used in few homebuilts anymore; its heavier, more complicated and more expensive than a four-cylinder Lycoming of the same power, which cant be fully offset by the engines smooth-running (at speed) nature. (Never mind the funny-car idle.) Continentals big-bore IO and TSIO-550 engines are popular for those needing 300 hp or more, and come in two main forms, one with Lycoming-style updraft induction-the intake tubes are below the cylinders, next to the exhaust headers-and the cross-flow version, with a tuned-length induction system said to improve cylinder-to-cylinder air distribution. Continental continues to sell only through kit manufacturers for this engine.

Rotax 100-hp 912S.

Continentals big push centers on reinvigorating the O-200, a descendant of the A-65 and the C-90, powering scores of Cessna 150s the world over. For the new LSA market, Continental lightened the engine and updated many of its antiquated (even by our standards) systems. Several kit companies have tried and liked the new O-200 Lightweight, and if market conditions were better, this direct-drive, 100-hp engine might give the Rotax 912 a real run.

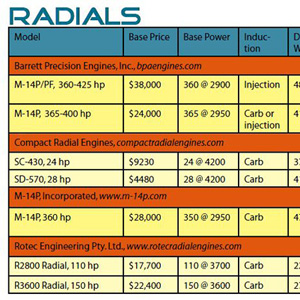

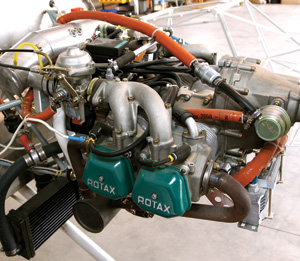

Rotax, New Giant

Austrian engineering ethos mustbe pretty simple: Design a fine little engine using a combination of utterly conventional techniques and old-is-new-again ideas, and then develop it piece by piece, nut by bolt, as field service accumulates. Thats what Rotax looks like from the outside, with the 912 family all but owning the LSA and lightweight Experimental/Amateur-Built market. At just under $19,000 to start, the 912S is in the same price range as the Continental O-200 and where we expect to see the Lycoming IO-233, but is significantly lighter (by 70-some pounds) and now possessing a very good reputation. Just less than $1900 separates the 80-hp 912 from the 100-hp 912S, which explains why the S is the most popular. Add $12,000 or so to a 912S and you can have the turbocharged 914, a fiery 115-hp engine that breathes a lot of life into small homebuilts.

Jabiru 3300.

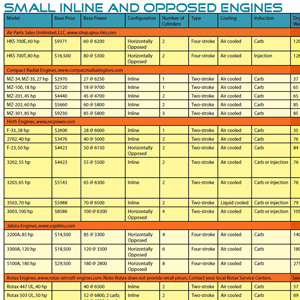

The Rise of the SmallAlternative Engine

Despite adverse market conditions, some small engine manufacturers continue to produce and develop product: Compact Radial Engines (whose engines are not actually all radials), Hirth, HKS and Jabiru can be counted among the living. Jabiru has recently made a series of small improvements across the board-affecting the 85-hp 2200A, the 120-hp 3300 and the elusive 180-hp 5100A flat eight-to improve cooling and lubrication. We also have UL Power, developer of a neat, direct-drive engine for LSAs (see Engine Beat, June 2010), a company and an engine we mistakenly left out of last years buyers guide.

UL Power 260i with FADEC.

Rattle, Rattle, Boom

Give us a second to take the gloves off here. In this space, we should talk again about diesels for aircraft. We’ve been promised a lot over the years, and have little to show for it. In fact, its our view that the only viable compression-ignition powerplant available to homebuilders is the Wilksch. As we said before, Continental isn’t interested in moving the SMA to homebuilts, neither Austro nor Thielert are likely to show up in homebuilts, and we’ve become convinced that the DeltaHawk is unlikely ever to be real enough to be given serious consideration. Wed love to be proved wrong. Really. In other diesel news, a company by the name of Engineered Propulsion Systems launched a development program late last year, but itll be awhile before we see hardware.

In the meantime, smart builders who intend to finish their projects, fly across country to visit family and generally enjoy their homebuilts the same way they might a Cessna or a Cirrus (only more so, of course), gravitate to known quantities. Say what you want about the technology apparent in a typical Continental or Lycoming (or Rotax), but they get the job done.