About 25 years ago, my wife and I designed our home. We were intrigued by a new home heating and cooling technology called Triathlon. It was conceived by a coalition of companies in an effort to take HVAC to a much higher efficiency level. Instead of using electric motors to drive compressors and pumps, the Triathlon system used a natural gas-driven piston engine. It also used a heat exchanger to use engine coolant to augment water heating. During an era when the highest SEER (seasonal energy efficiency ratio) ratings were in the low teens, the Triathlon’s equivalent rating was an eye-popping 27. We had three of the units installed at our home and for a couple of years we enjoyed utility costs roughly 40% less than our neighbors.

After a while, the dream started to fade. Two of our systems never had any trouble, but the third was down for its second engine failure when we were informed by our installer that the coalition was searching for a new engine supplier. Expensive preventive maintenance procedures were implemented at the owner’s expense, which eroded a lot of the energy cost savings. Lawsuits ensued between the coalition companies themselves, their contractors and the end users. Abruptly, the product was pulled off the market and owners were essentially forced into a recall by a one-time offer to replace the units with conventional electrical units. The whole package was a great concept that made a lot of sense, but in the end the bleeding-edge technology, well, bled out instead.

After a while, the dream started to fade. Two of our systems never had any trouble, but the third was down for its second engine failure when we were informed by our installer that the coalition was searching for a new engine supplier. Expensive preventive maintenance procedures were implemented at the owner’s expense, which eroded a lot of the energy cost savings. Lawsuits ensued between the coalition companies themselves, their contractors and the end users. Abruptly, the product was pulled off the market and owners were essentially forced into a recall by a one-time offer to replace the units with conventional electrical units. The whole package was a great concept that made a lot of sense, but in the end the bleeding-edge technology, well, bled out instead.

How About Airplanes?

Building an Experimental aircraft can, like the Triathlon example, involve tempting new technologies. After all, it’s one reason many of us build: to be free of certification mandates. But not all of these freedoms of choice present the same level of risk. It’s ultimately up to the builder to decide which deviations “from the norm” are worth the risk, assuming he can even accurately assess the risk level. It’s not always easy to separate the marketing efforts from the truth. Still, the industry as a whole has improved dramatically over the last couple of decades. A few examples will help illustrate the point.

Vacuum Out, Electrons In

When I started my RV-10 build in 2007, it was an era of rapid change. Steam gauges were on their way out for most categories and first-generation EFISes were established, though they were already in the process of being overtaken by the next wave. By 2007, Blue Mountain and Chelton, two early efforts, had left the market and largely orphaned their products and customers. Some installations limp along in an unsupported state, but most have been replaced.

Builders who invested in these packages didn’t regret the decision immediately but, eventually, when support evaporates and even things like database updates become a chore, it comes time to tear it out and start over. To a great degree, the next wave learned from these mistakes, so the likes of Dynon, Garmin and Grand Rapids (now just GRT) and MGL presented more mature and supportable products. Many of which are still viable today.

The danger with these early electronic panels was their total integration, with instruments, moving maps and autopilot functions relying on the health of the whole. Lose one piece of the puzzle and not much of anything works. This made jumping into cutting-edge technology fairly risky, especially as viewed from today’s perspective of mature, across-the-board solid products.

Some Vaporware

Another curious “almost” market entrant was Aveo of the Czech Republic. For a time they were on the airshow circuit showing attractive demo screens that they claimed were soon coming to the market with leading-edge features at bargain basement prices, like full glass screens with autopilot for less than $10K. At one point their marketing was so brash that they bragged that their new avionics line would give their competitors “heart attacks.” Bravado aside, after delivery promises came and went, the product line was never actually introduced and the company instead quietly focused on its successful line of aircraft lighting products with little fanfare.

The point is this: We may wish for more innovation in instruments and avionics today but the products are almost universally capable and reliable. I would expect all of the bigger players—Garmin, Dynon and Advanced Flight, GRT and MGL—to still be around for the next 15 years. But I’m no expert as at one time I was a credit card CVV entry away from a full Blue Mountain panel. Phew.

Conceptual Thrust

As I was squeezing the first rivets of my empennage kit, there were two key engine options. Van’s originally built two prototypes, one with the common 260-hp Lycoming IO-540, and a second one with a 210-hp Continental IO-360. The performance numbers between the two were surprisingly close, but early orders and customer feedback showed that RV-10 enthusiasts tended to be a lead-footed bunch with a “no replacement for displacement” mentality and the big Lyco dominated to such a degree that the smaller/cheaper Conti program was scrapped.

Some builders, either from a bad experience with a certified engine or the belief that these relics from the 1940s can’t be any good, began considering alternatives. There are two main problems involved. First is that it’s unlikely the airframe manufacturer has tested with or developed a firewall-forward kit for anything but the most common aero engines. Second is that the stability and viability of the company selling the alternative engine is often difficult to ascertain—and yet is absolutely crucial to the endeavor.

In the early days of the RV-10, there was a lot of hype about a turbo Subaru complete FWF package. There were also a couple of automotive V-8-based options targeted at RV-10 builders with amazing (blue sky) performance numbers along with attractive acquisition and operation costs. Deeper in the weeds were the odd turbine, rotary and diesel concepts. The brochure numbers always seemed to pencil out nicely, with emphasis on pencil.

Options came and went. Developers died, quit or closed up shop on Gen-1 customers and opened a new shop under a new name for a new generation. To my knowledge, no offering from the original menagerie still exists in the RV-10 marketplace and I surmise that one could count on one hand the airplanes flying today with one of those early engine packages.

What many early adopters fail to recognize is that any alternative-engine program—whether it’s from Lycoming, Continental or the guy down the hangar row—requires an incredible amount of development in both time and money. Just getting it hung on the firewall isn’t enough. Getting it through Phase I isn’t enough. Getting a handful of engines through a couple hundred hours isn’t enough. And the more complex the engine installation, either mechanically or electronically, the harder this job can be. It takes time even to start learning what you don’t know.

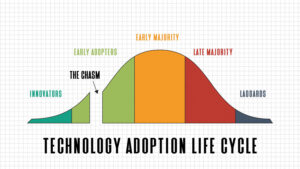

My feeling is that these builders, the early adopters, didn’t fully appreciate that they were part of the beta-test program, despite the claims and testimonials offered by the companies selling the packages. The risks inherent in any kind of development program become their risks, too. Sometimes this is economic but it can be physical risk as well.

I looked at the numbers. A high proportion of early RV-10 accidents involved alternative engines. The correlation was later affirmed when the alternative products mostly left the marketplace and the safety record improved. In the grand scheme of things, the numbers were small but significant enough for insurers to take note of—some cost justification to go alternative was lost to higher insurance premiums on top of a reduction in resale value. In truth, this reduction is twofold because the presence of a non-factory-sanctioned engine takes a large number of potential buyers off the table, regardless of asking price.

Broken Dreams

There were some quality kits on the market 15 years ago and there are even better kits available today. Van’s just celebrated their 50th anniversary but they are far from the only high-quality game in town. There are several kit vendors who provide high-quality, well-designed products and have the capitalization and commitment to provide quality support well into the future. Nevertheless, it must be acknowledged that even Van’s wouldn’t be around today without early RV-3 pioneers being willing to invest in an upstart for some hand-drawn prints and basic raw materials.

Over time there have been some slow and steady successes and a few flashes in the proverbial pan that by and large didn’t “pan” out. Concept to cornfield, in hindsight the red flags seem apparent. Lots of hype but little gravitas on an arc that is usually parabolic. If someone comes out of nowhere touting amazing performance for a meager investment it is usually a red flag to abort.

So why have Van’s and other long-term companies succeeded and others failed? That’s a debate for the ages but in my non-degreed opinion, it is simply the fundamentals of any successful business. Long-term vision, quality products, fair prices and service after the sale. Deliver what you say you’re going to deliver—and close enough to when you said you’d deliver—that your customers keep the faith.

Be wary of tantalizingly low product prices. Quality costs what it costs. Performance costs what it costs. Engineering costs what it costs. (Plus 15% for the coffee budget.) For any kit-sourced aircraft to have a bright future for all concerned, it needs to be produced properly and priced profitably. Nobody has figured out how to buy aluminum cheaper than Van’s or composites at lower cost than Boeing.

To me, the most amazing aspect of the recent RV-15 reveal at AirVenture had nothing to do with the airplane itself, nor anything to do with the literal moat that was pressed around its parking spot by thousands of onlookers. The most amazing thing to me was the millions of dollars in deposits that could have been accepted at the show but were refused because the project “wasn’t ready yet” for deposits, even though checkbooks were being waved like handkerchiefs.

The Takeaways

Should you find yourself considering non-mainstream choices in your build—in terms of avionics, engines or the kits themselves—ask a few questions.

• Is there evidence of internal capitalization of research and development? Conversely, customer-based R&D capitalization is a flashing yellow master caution light.

• Does the project you’re considering deviate from the original engineering of the chosen design in any material ways? Any deviation from the basic design adds exponentially more time, effort and frustration to any project. There is no such thing as a “simple replacement” on an airplane designed by somebody else.

• If it sounds too good to be true, it is. If you hear of a turbine engine that uses less fuel than the best aircraft engines, you’re probably getting cherry-picked numbers. If Pratt & Whitney can’t do it, a couple of guys in a business park can’t either.

This is an industry that needs innovation and experimentation to thrive, but it also needs stability and staying power to survive. Maybe someday some bold upstart making flashy claims with pretty CGI concepts will crack the code and actually produce something that sends us all back to the drawing board and takes over our market. Maybe. But the most successful kit manufacturer on the planet got there by incremental improvements, cautious and iterative engineering and a conservative business plan. Think about that.